Data from Public Records Request of FUHSD: “Square-footage tax is fairer than current fixed amount parcel tax”

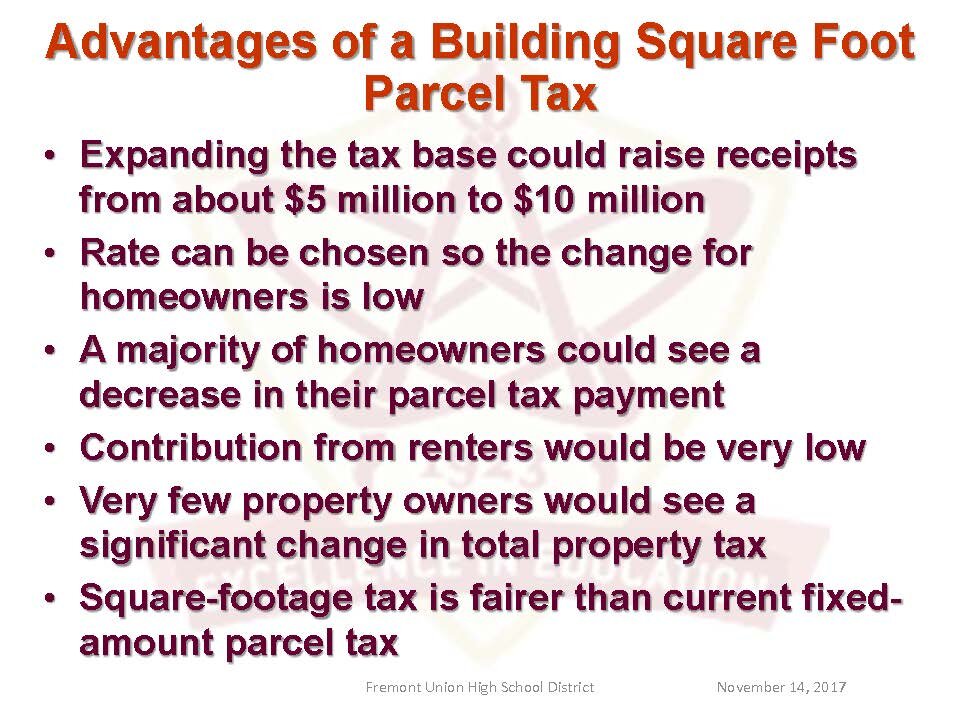

Thanks to a Public Records Request by a campaign volunteer, we have, as of today, the 2017 research by FUHSD regarding whether they should try to pass a square foot parcel tax. Experts agreed that the “square-footage tax is fairer than current fixed amount parcel tax” yet FUHSD elected to try to pass a fixed amount parcel tax on the ballot this November.

The FUHSD data yielded some surprising results mixed in with that district deciding not to try the square foot parcel tax: 71% of respondents did not know they paid less than $100 per year in parcel tax to the district. 73% of renters supported the square foot parcel tax. Only 19% of respondents felt there was a “Great need” for additional funding for FUHSD and 44% felt there was “some need.” Council candidate Hung Wei had been a trustee for FUHSD when this report was made. The superintendent of FUHSD is compensated nearly $500,000 per year, while FUHSD is not looking at closing schools and officials are asking voters to approve Measure M, another parcel tax, but not the ‘fairer’ square-footage tax, rather the same current fixed-rate parcel tax.

I bring this up because FUHSD does not have the same funding problems which CUSD has, and is not facing 4 school closings, therefore, CUSD would definitely need to do their own polling and outreach on the square-footage tax issue, relying on old data from a different district is unacceptable given the school funding situation. CUSD definitely needs to look into the fairer tax: square footage method tax.

The following three files (top to bottom) are the reported data on the phone poll, the questions and results of the phone poll, and the FUHSD report which includes a study about the different ways the square footage model could be applied and the statement: “Square-footage tax is fairer than current fixed amount parcel tax”