How a Square Footage Parcel Tax Plan could Help CUSD

Updated October 18, 2020: I no longer support Prop 15. While there is clearly a disparity between the commercial and residential property taxes, I do not believe this is the time or the correct method to fix the problem (assessing commercial at market rate will harm small businesses). Clarified this proposal would affect all CUSD parcels, not just Cupertino parcels. Added link to July 21, 2020 City Council meeting, agenda item 20, Prop. 15 discussion RE CUSD. Added simplification of tax and approval rate. Added Measure A. Clarified paragraphs. Emphasized the senior exemption. Added a test calculation and information regarding the square footage for Cupertino.

The Cupertino Union School District (CUSD) failed to convince voters in March 2020 that they should add $125 to their parcel tax. How about not increasing the parcel tax on single family homes, yet spreading the burden of taxation equitably?

Sound interesting?

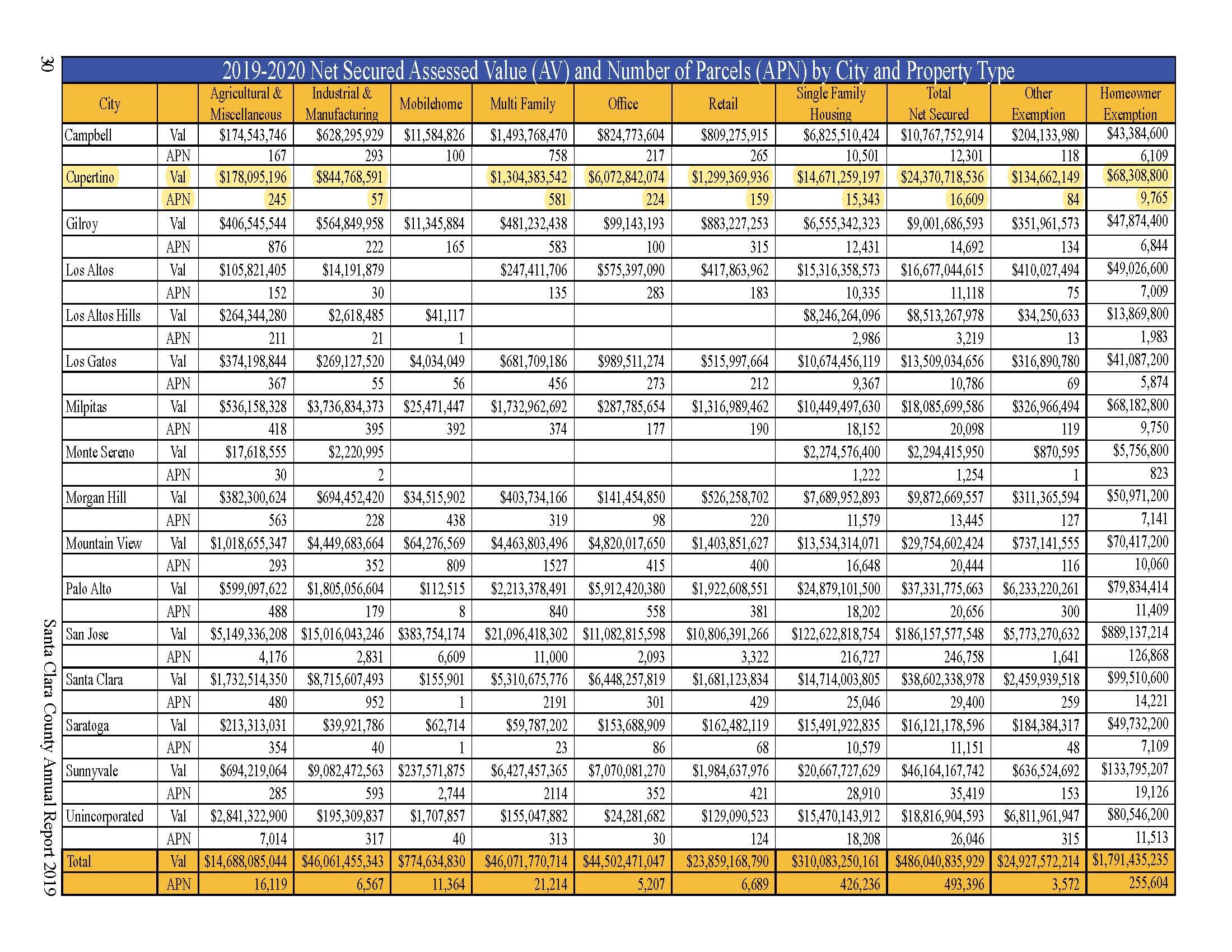

A Square Footage tax, modeled after the BSEP plan, would tax development on a per square footage basis and get rid of the inequity where an apartment building with 1,000 units would have perhaps 800 students, constantly, and only pay $250 in parcel tax annually, while a single family home would pay $250 annually and have 2 students over a decade until they graduate. If these structures were taxed on a square footage basis, the inequity would resolve. This proposal would affect all parcels within the CUSD district, not just Cupertino Parcels. See the table below which shows how many parcels are within Cupertino, vs. how many are in CUSD: 16,609 vs. 39,246.

CUSD needs to ensure they will not become beholden to Cupertino's developers to give one-time band-aid cash deposit "Community Benefits" to CUSD with no long-term solutions and which ultimately worsens the area for everyone. This has been and continues to be a bad idea. This foolishness doesn't fix systemic funding problems in the long run, and saddles the community with bad projects they are stuck with for decades. Nobody wants this other than developers who know the financial math doesn't work out for the community.

Background

In March 2020, Cupertino Union School District (CUSD) voters sadly voted no on a CUSD parcel tax (Measure O, $125 additional parcel tax, per parcel, for 5 years) when the district is in need of funding. Along with cutting costs, the district could move to a square footage tax measure for the schools.

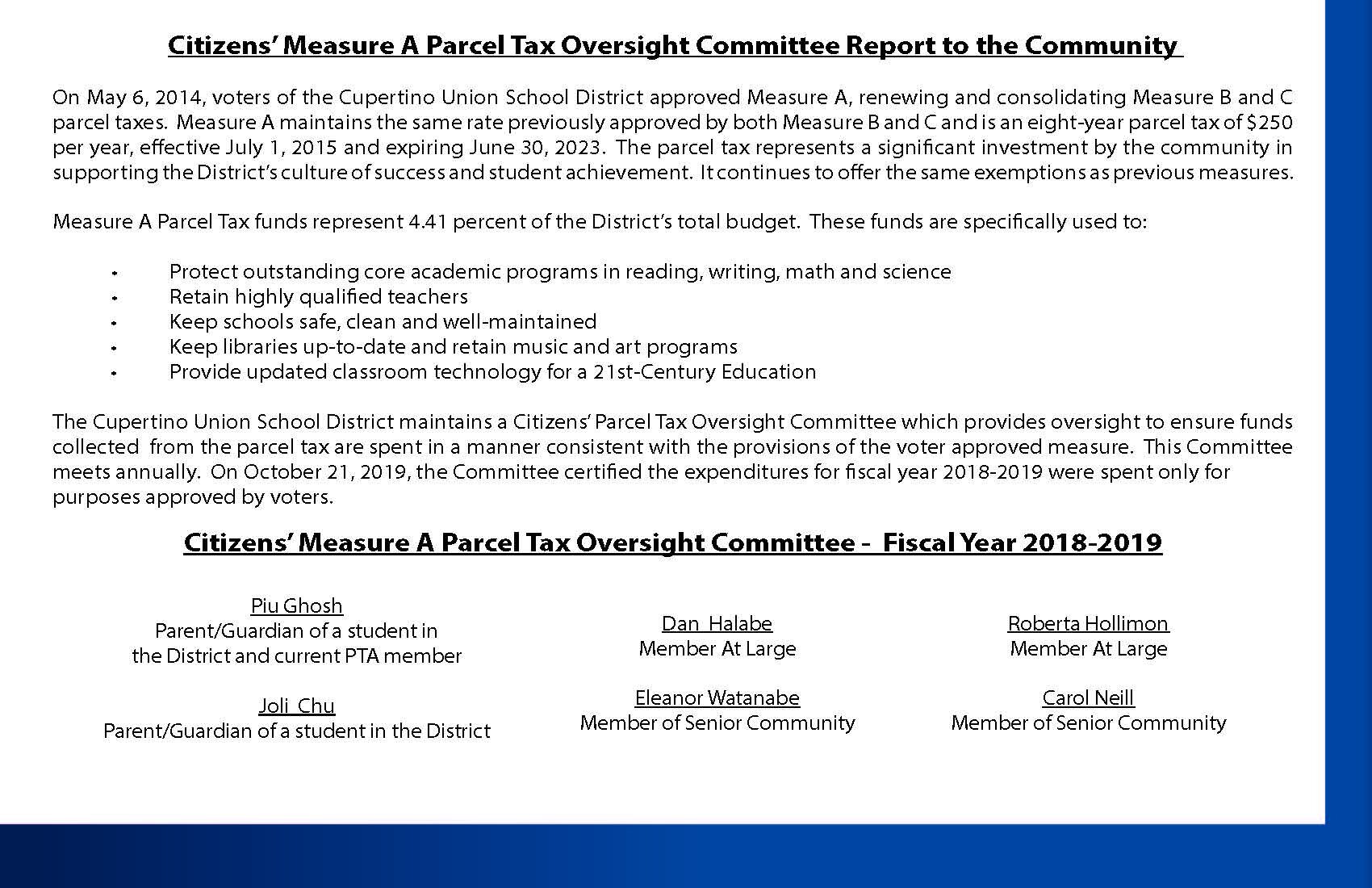

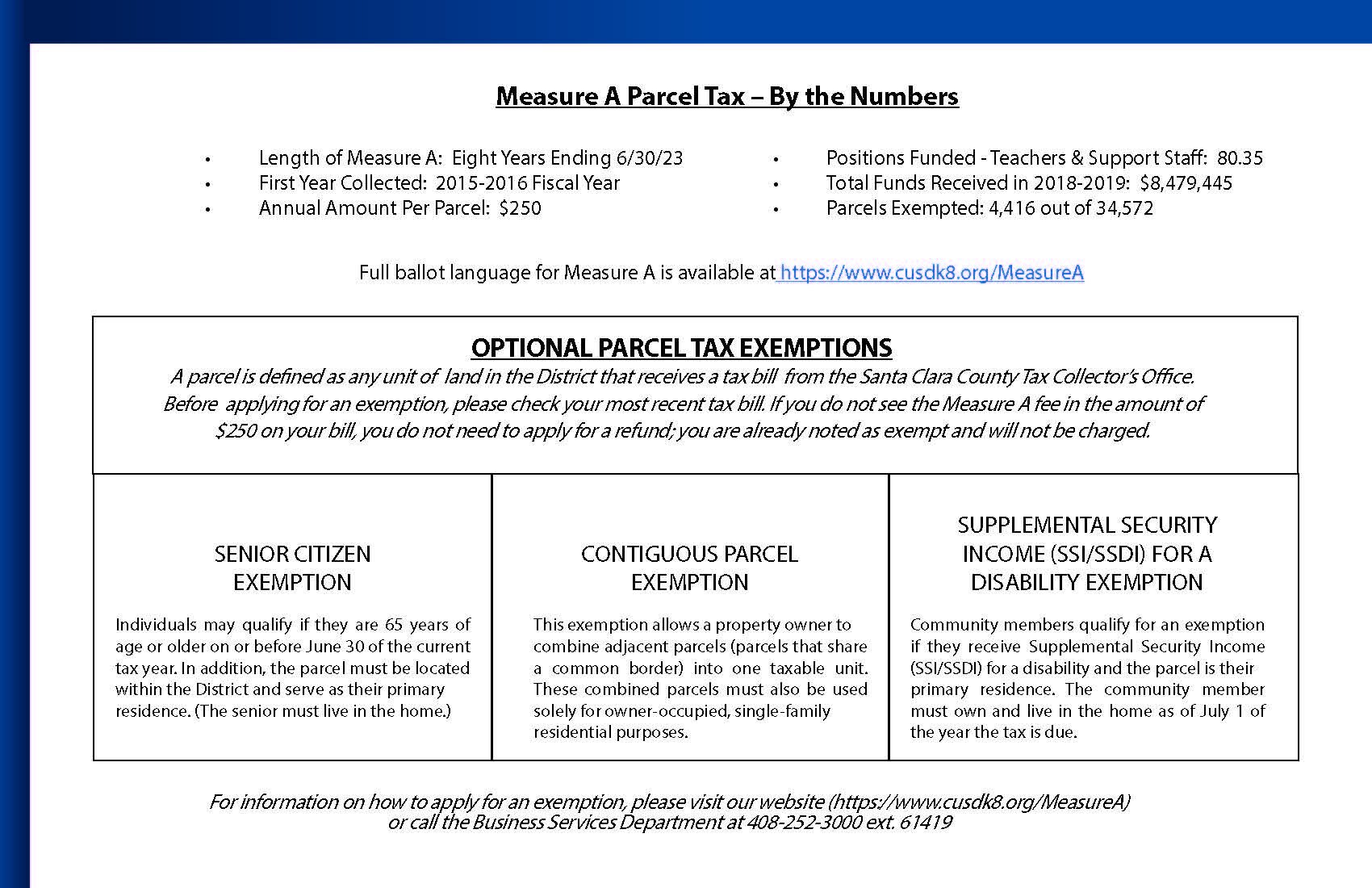

Current Measure A is a parcel tax of $250/parcel regardless of size of the development on the parcel or number of residential units per parcel.

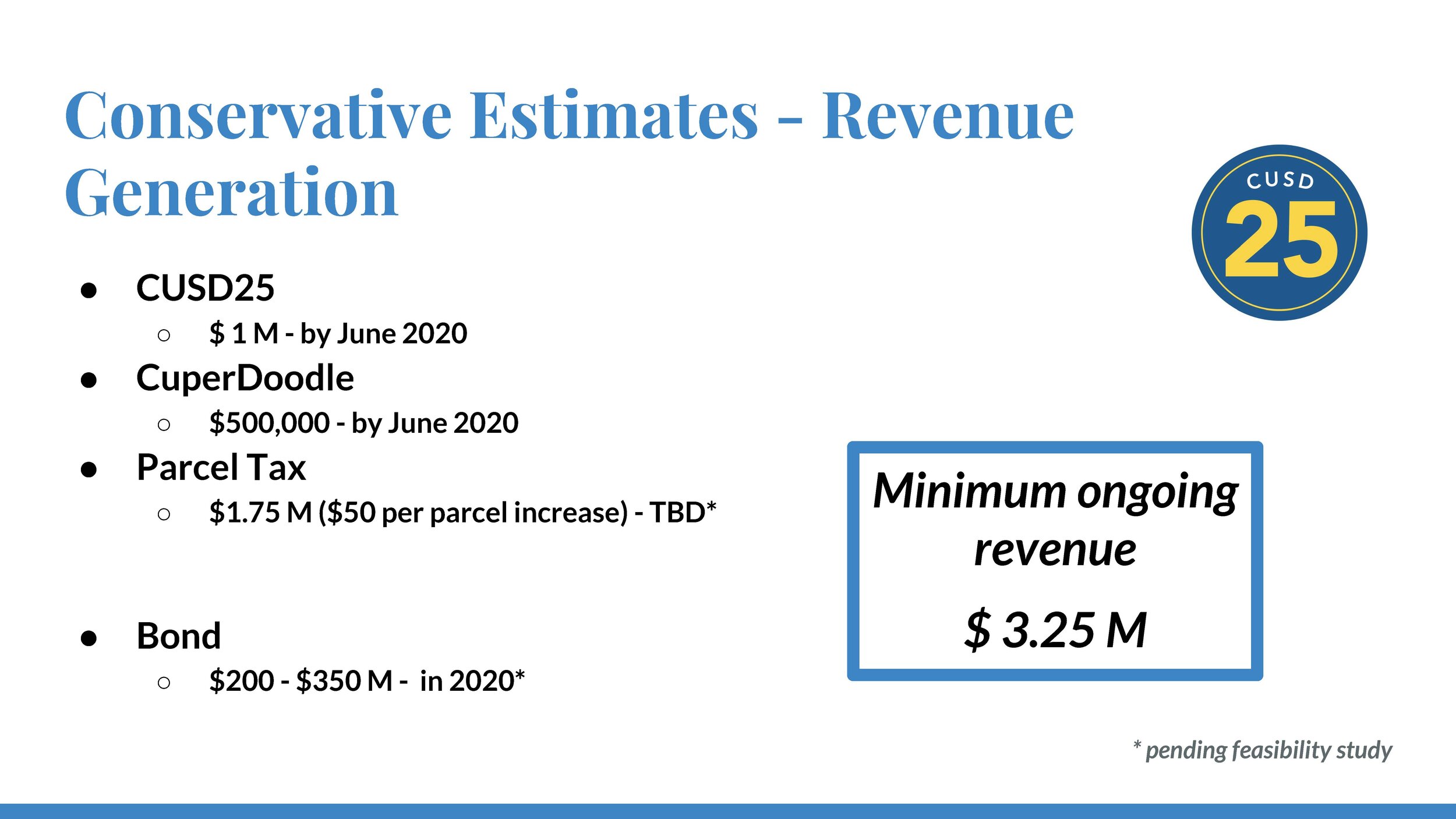

The parcel tax measure which failed in March 2020, called Measure O, was an additional annual parcel tax of $125 per parcel for five years, which would generate only an estimated $4.3 million per year in revenue.

Current Measure A, a $250 per parcel tax measure, provides $8.5M in funding and ends June 30, 2023.

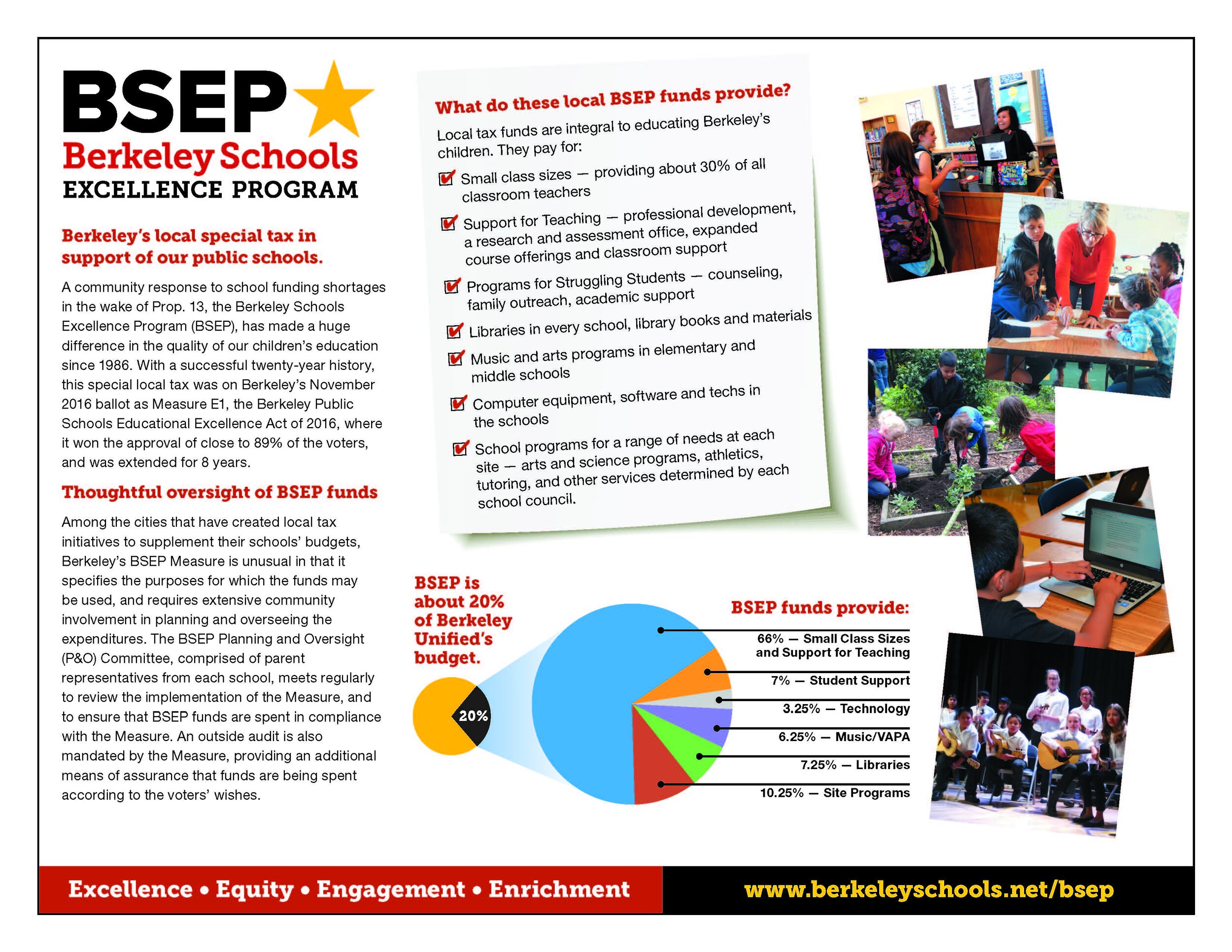

There are alternative means to increase funding to provide for our school district, other than the per parcel method and one very intriguing concept which could help level the parcel tax issue is the Berkeley Schools Excellence Program (BSEP). The BSEP plan is a per square footage plan as opposed to by parcel.

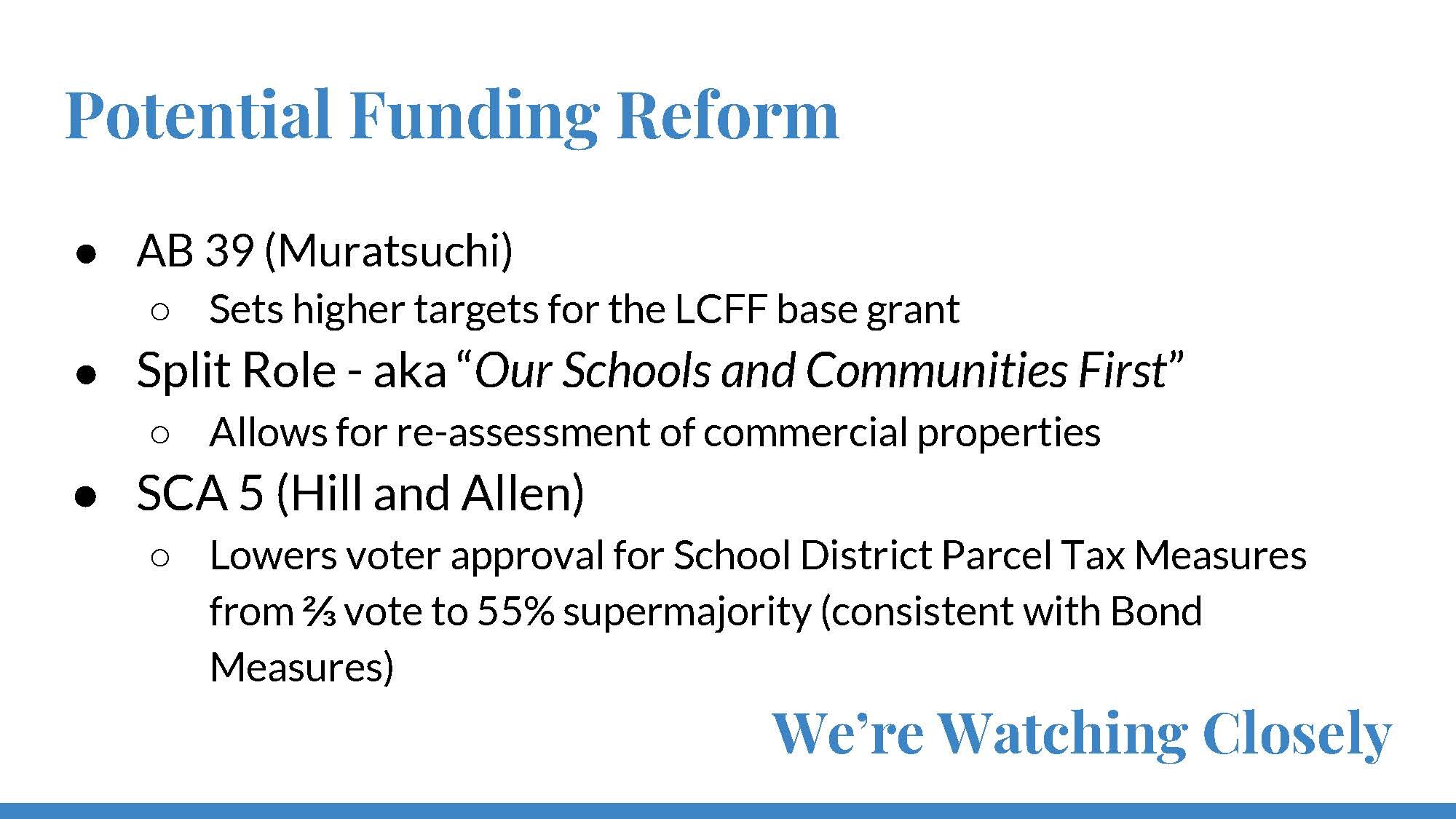

The potential impact of Prop. 15 adding funding, is discussed below, and the ending of the current parcel tax method and converting to a BSEP plan would need evaluation and negotiation to maintain current funding levels and transition. Regardless, it is important to keep an open mind about alternatives to provide a resolution to this continuing funding problem.

CUSD Boundary Map

What is Measure A Providing?

In a nutshell, Measure A provides $8.5M in school funding from 34,572 parcels each paying $250 with 4,416 parcels exempted. The Citizen’s Measure A Parcel Tax Oversight Committee report below has more specifics:

Why does CUSD need Help and How Much?

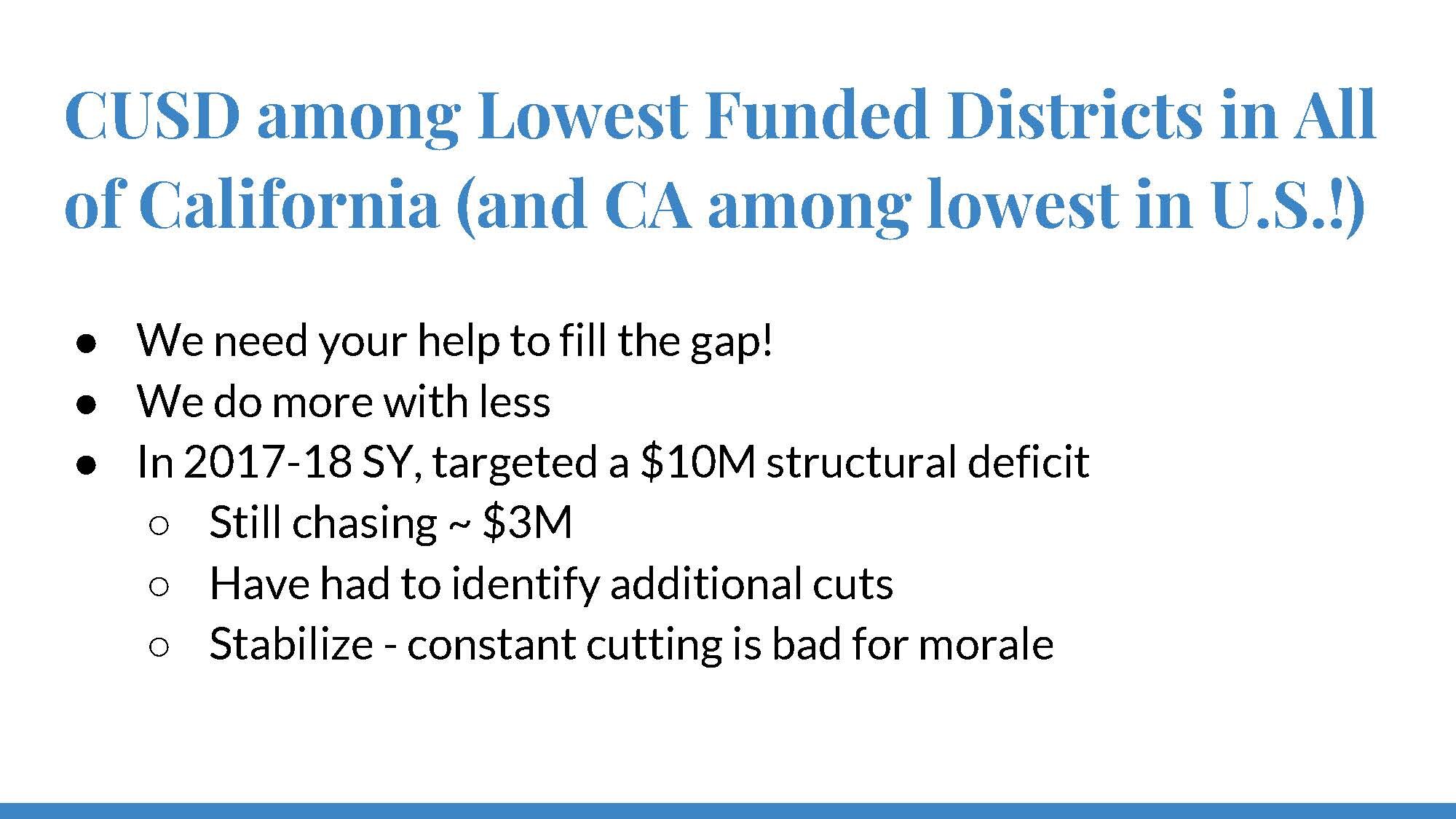

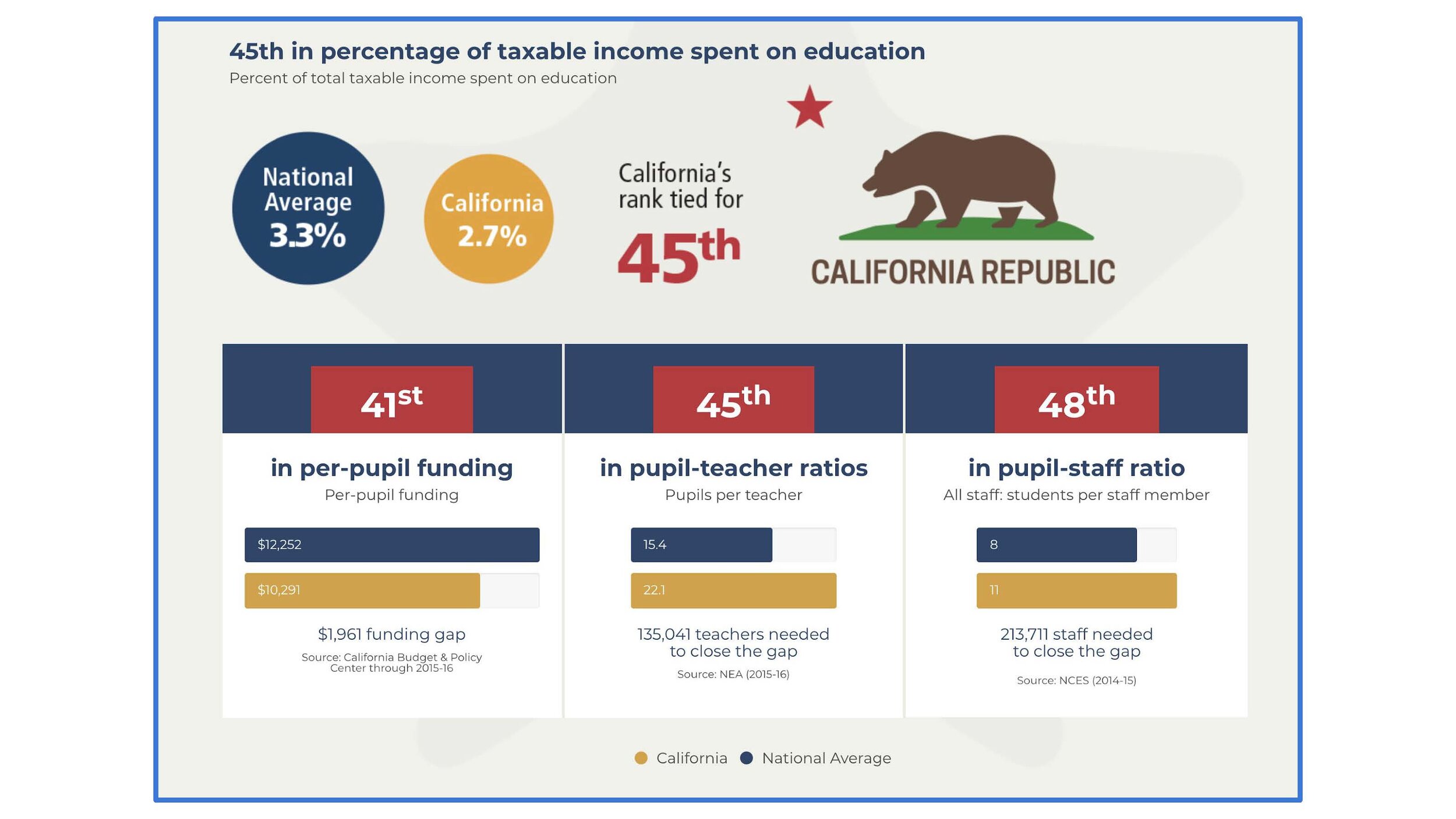

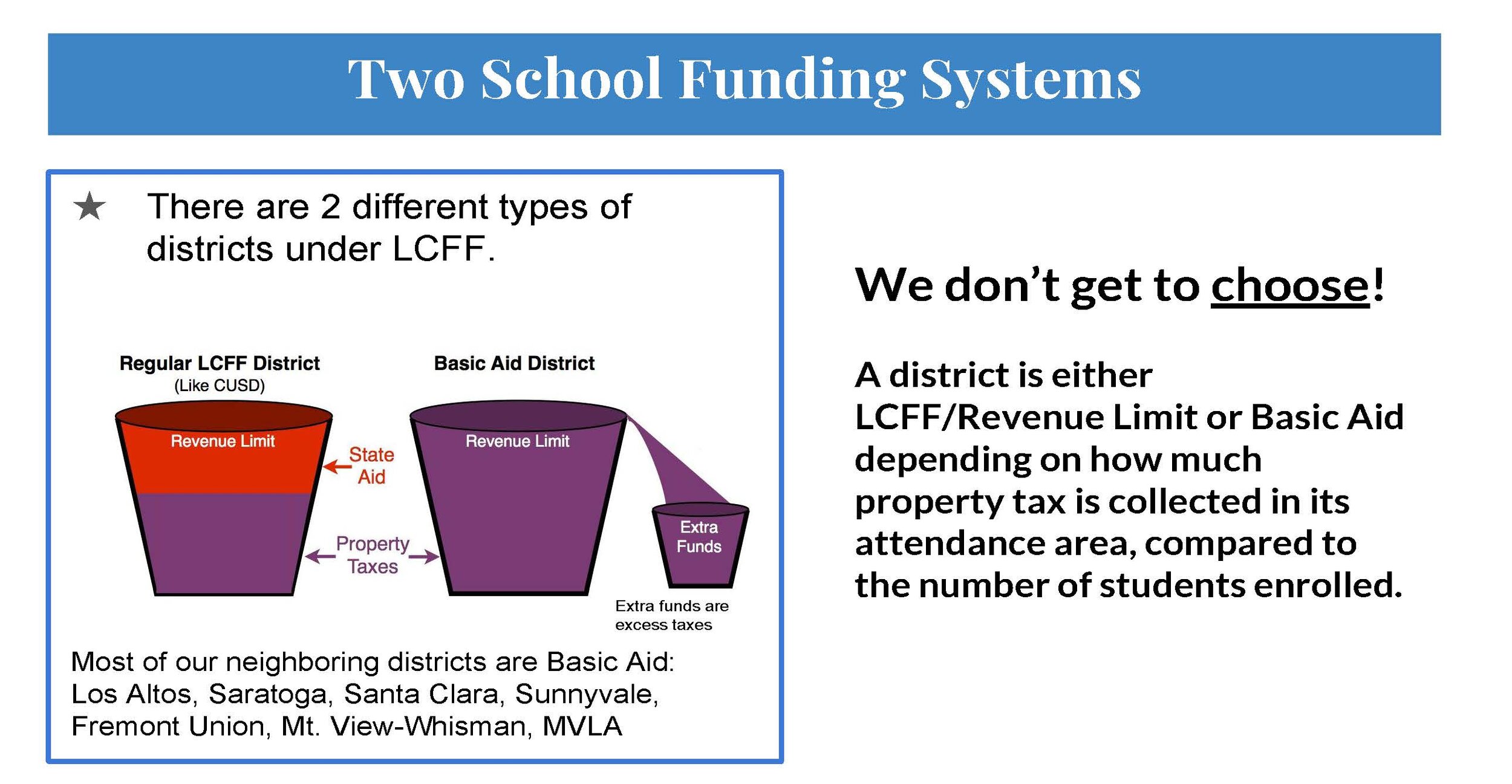

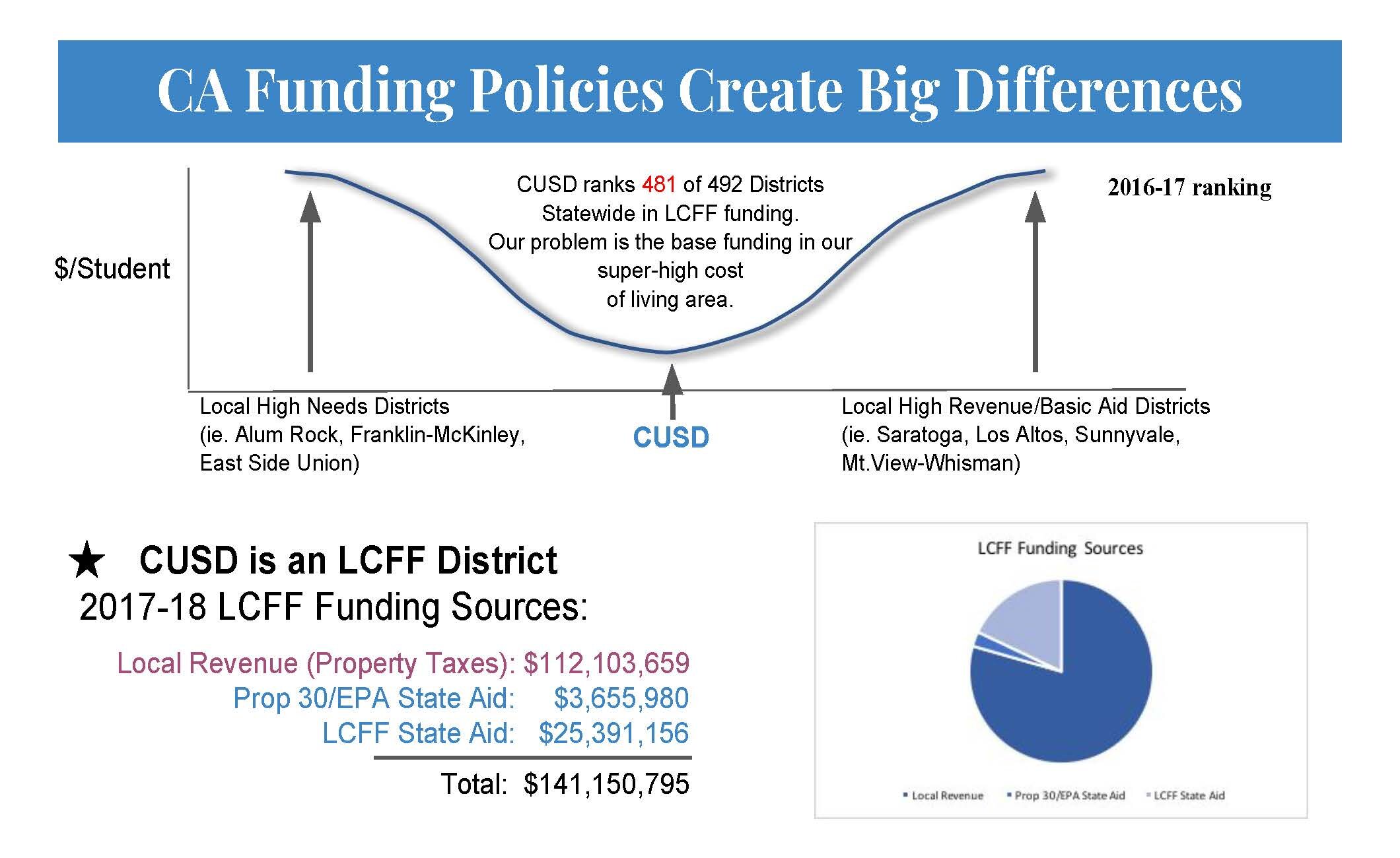

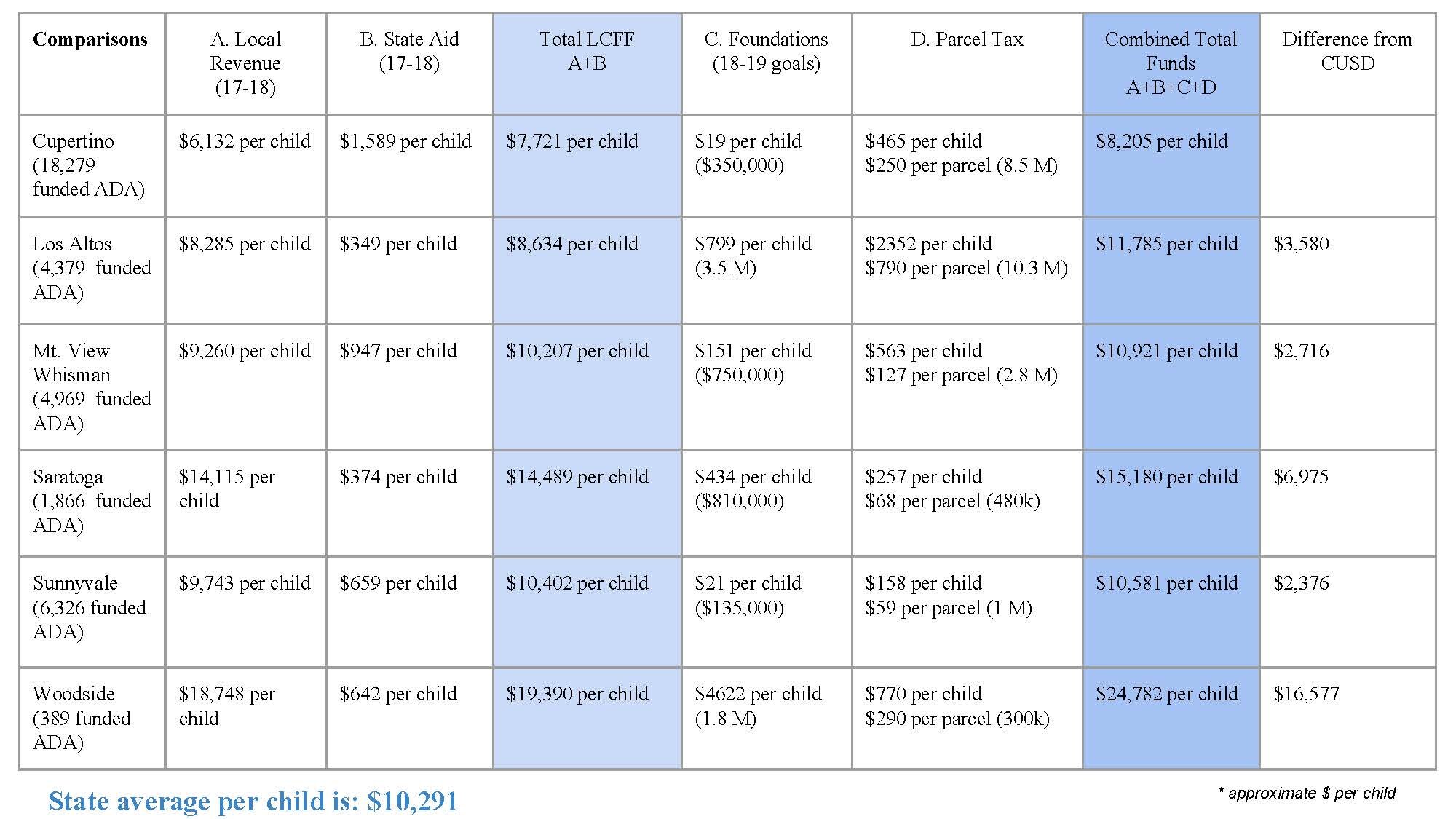

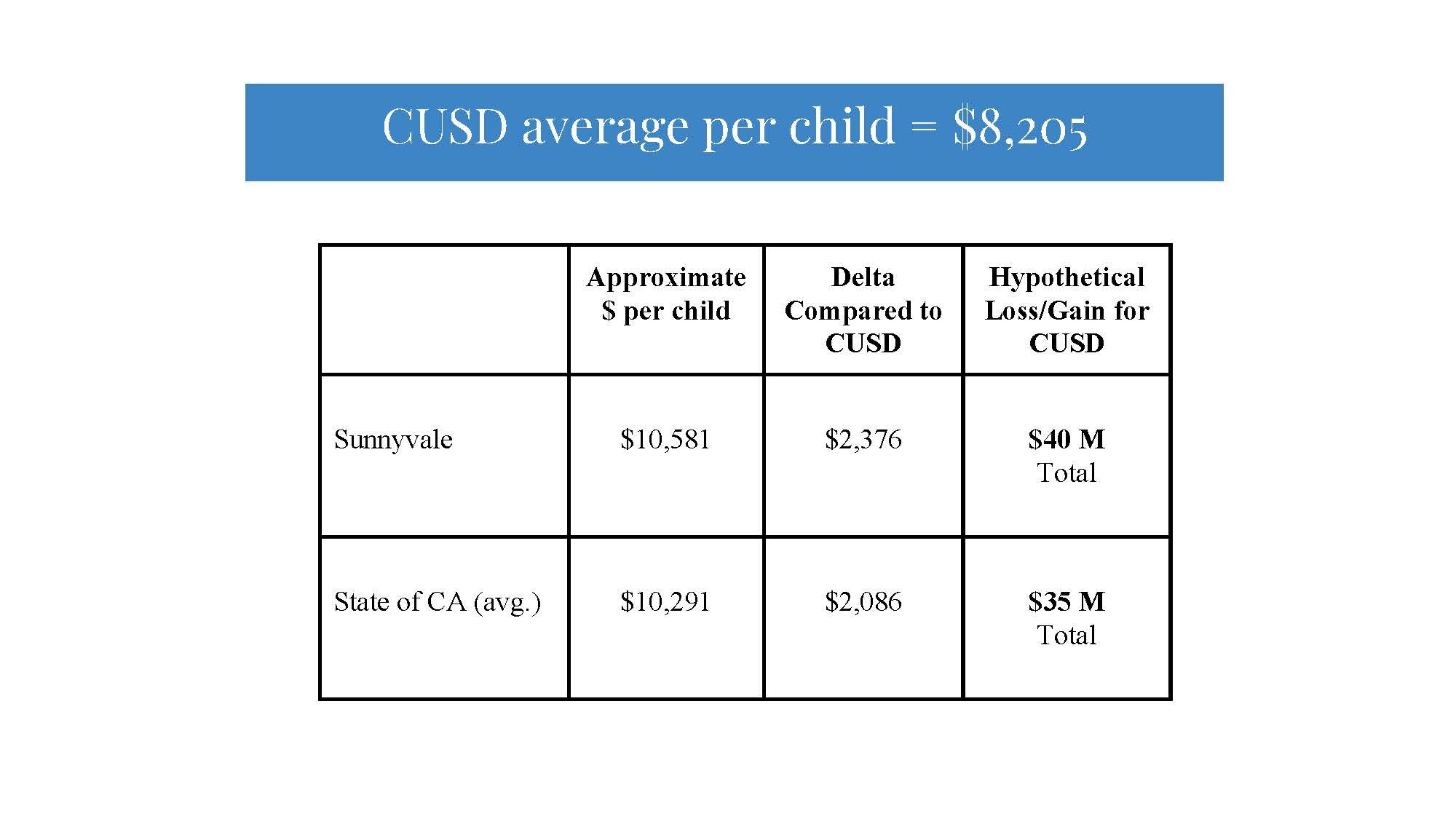

CUSD lags behind our neighboring schools’ funding by a minimum of $2,716 per student annually. Cupertino ranks 481 out of 492 for Local Control Funding Formula (LCFF) funding each year. To bridge the funding gap would require $17 Million annually for every $1,000 increase.

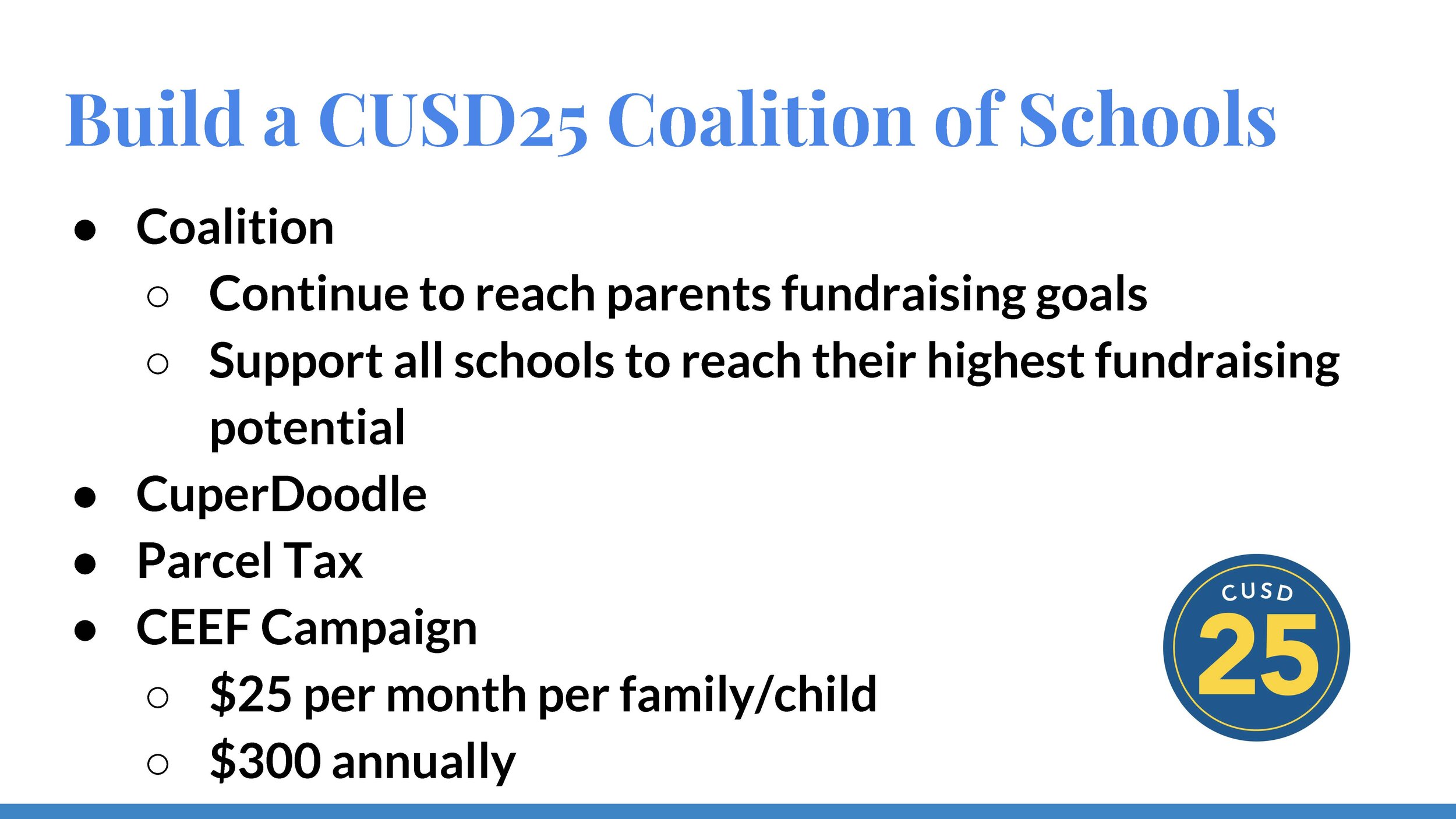

Note that in the final slide of the CUSD presentation above, the parcel tax was not approved and there was no bond measure on the March 2020 ballot or upcoming on the November 3, 2020 ballot. The CUSD funding presentation is available to download here.

This slide emphasizes the differences in per pupil funding in the local area. The entire slide deck from CUSD is available here.

What is BSEP?

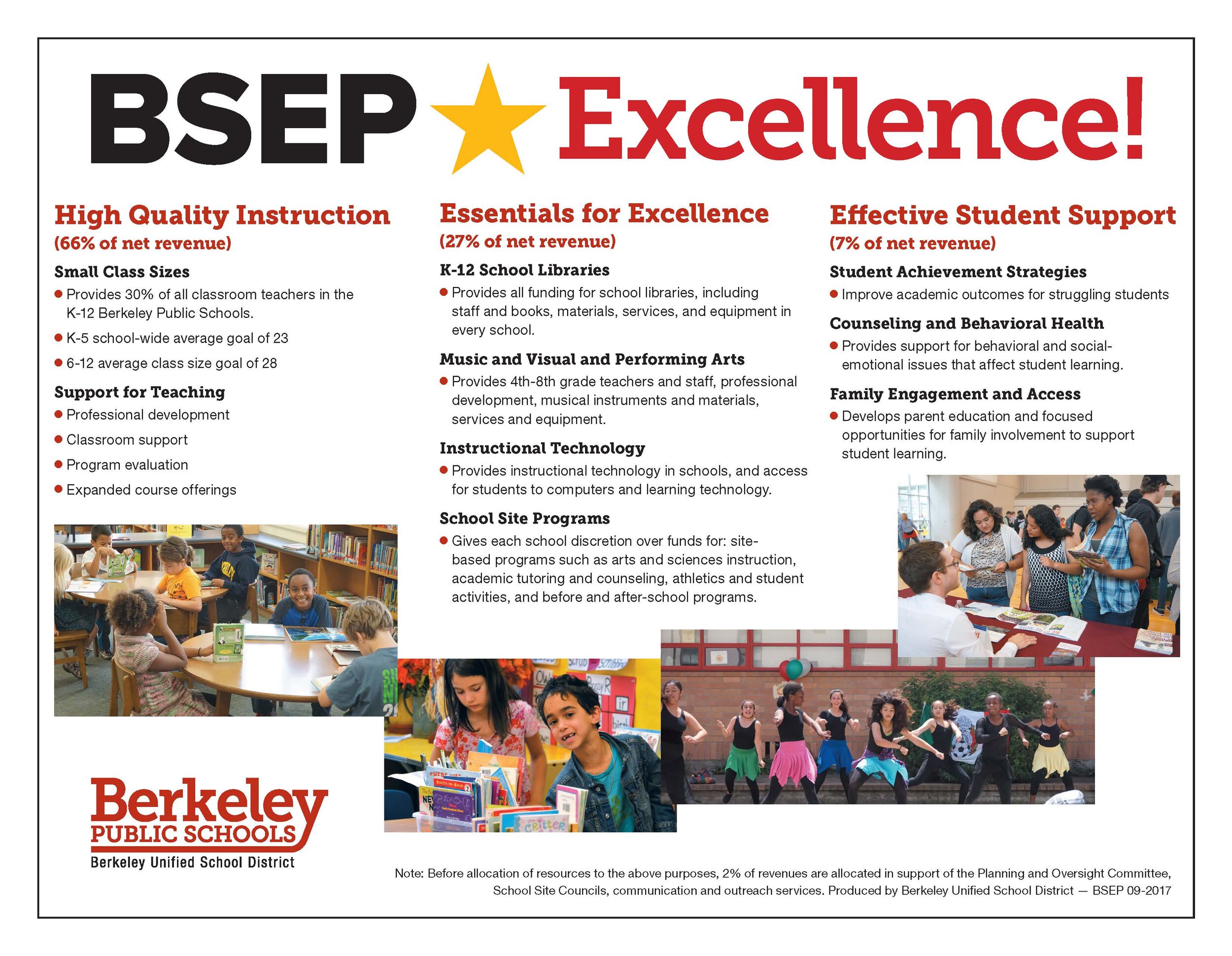

The Berkeley Schools Excellence program is a parcel tax based on square footage as opposed to parcel. The following is a brief overview of BSEP:

How does BSEP work?

Currently, in Cupertino residential property owners pay a CUSD property tax rate of $250 per parcel, regardless of how many residential units are on that property. For instance, a property with 1,000 apartments would pay $250 and a parcel with just one home would also pay $250. The apartment building could have many renters moving in and out over the course of decades, with thousands of students attending CUSD, yet each year only $250 would be paid in parcel taxes. What the BSEP plan does, is tax properties based on square footage making taxation proportional. What this does is allow for accounting of the size of properties. The following excerpts are from this BSEP FAQ page which includes links to more information:

The Berkeley Schools Excellence Program (BSEP) is a special local tax measure, first passed by Berkeley voters in 1986 as a response to school funding shortages in the wake of Proposition 13. It currently provides 20% of the funding for the Berkeley Public Schools. This short video provides a simple summary of the history of BSEP and what the local funding provides for Berkeley students.

(…)

The tax rate is calculated based on the square footage of improvements (buildings, structures) made to each parcel. Due to a recent legal ruling that affects all California school special taxes, the 37¢ per square foot tax on improvements is required to be the same (“uniform”) for commercial and residential properties.

(…)

Based on a tax of 37 cents per square foot of developed property, a Berkeley home of 1200 square feet would provide $444 per year. This is an increase of about $96/year. A homeowner (or business owner) with a building that is 1500 sq.ft. would pay $555 per year, and so on. There is a low-income senior exemption for paying this tax.

The amount of the BSEP tax would require community outreach and input from all stakeholders following the process outlined by the BSEP program. CUSD needs some combination of fiscal reductions and funding sources. If Prop 15 were to pass (“split roll”) the increase to CUSD would be approximately $9.3 Million as reported in item 20 of the Cupertino City Council meeting on July 21, 2020. Even with Prop 15 funding, CUSD would need another $25M annually to be comparable to neighboring districts per student. Targeting the inequity of the parcel tax system we have in place now along with supporting CUSD-led budget adjustments to address funding shortfalls, could be a prudent long-term solution locally to our funding disparity relative to other schools.

How Much Revenue Could a BSEP-type Plan Provide CUSD?

The BSEP plan has a $0.37/SF parcel tax based on developed square footage. Chapter 3 of the Cupertino General Plan “Land Use and Community Design” Table LU-1 on page LU-13 has the following table:

Commercial and office total 12,548,244 square feet (sf). The LU-1 table has hotel and residential by rooms and units. Until an agency can provide the exact square footage for hotel and residential assume an average for each of 1,400 sf/hotel room (includes lobby and common areas) and 1,500 sf/residential unit. Total square footage in Cupertino alone is approximately 46,228,644 sf. A $0.17/SF parcel tax just on Cupertino property would generate $7.9M annually, and the BSEP rate of $0.37/SF would generate $17.1M annually, however, this is just property in Cupertino and not the entirety of CUSD, a $0.1/sf tax on the entire district would generate approximately $7M-$9M across the entire district. The current $250/parcel tax generates $8.5M by comparison, but this is for the entire district. Cupertino city parcels generate approximately half of the Measure A funds.

As mentioned previously, Prop. 15, if it passes, and I am presently opposed to it, is anticipated to add $9.3M to CUSD’s budget annually. See July 21, 2020 Cupertino City Council Meeting @ 1:48https://youtu.be/1NdNDCy_Ev4?t=108 Study by Blue Sky Consulting Group.

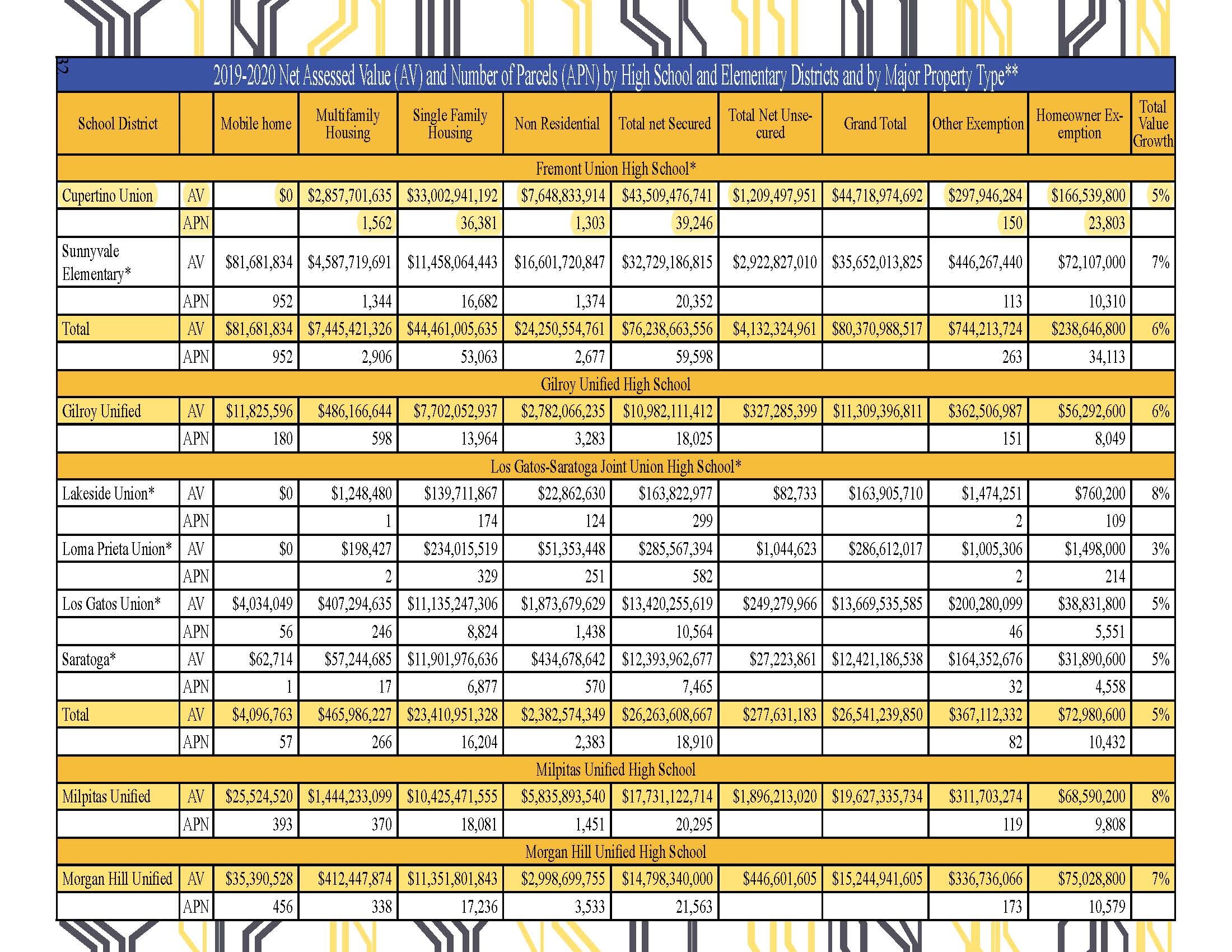

This is a preliminary review of the option which would need more precise data and evaluation. The following tables are for those individuals further interested in making some estimations on their own.

For further information see the “Annual Report 2019-2020 Office of the Assessor Santa Clara County” excerpt pages shown here, with Cupertino and CUSD data:

Together, with Cupertino City Council supporting CUSD, we can ensure our students retain the quality education our award-winning schools are known for.